AL Form AR 1997-2024 free printable template

Show details

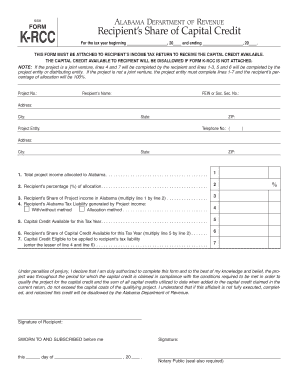

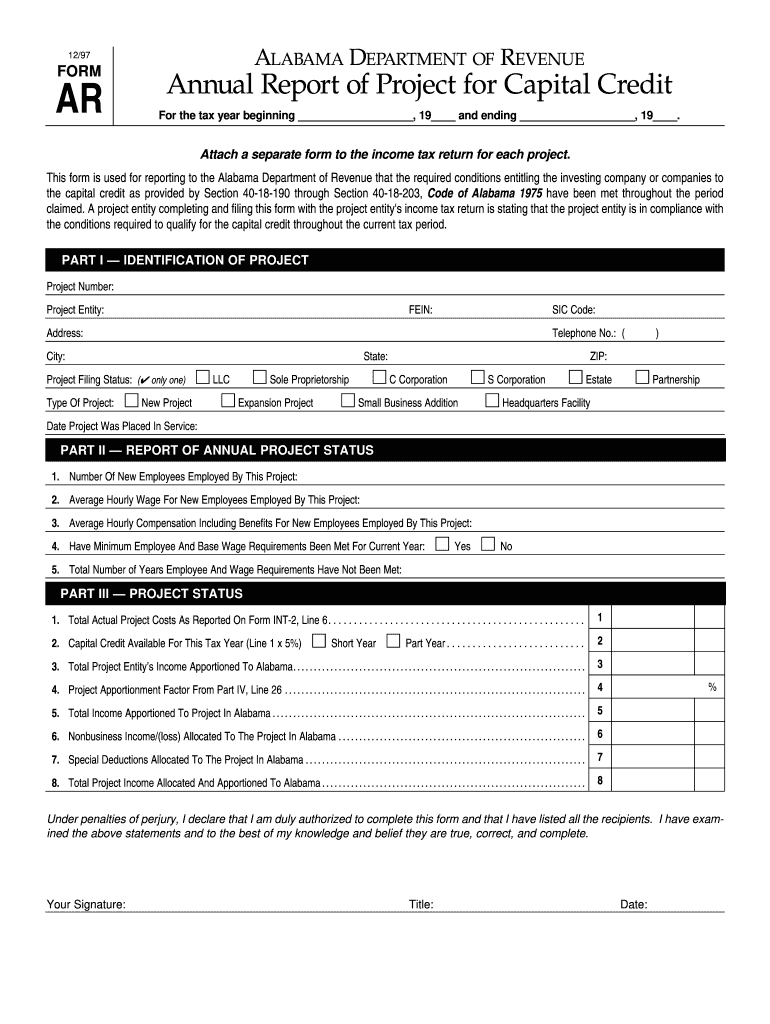

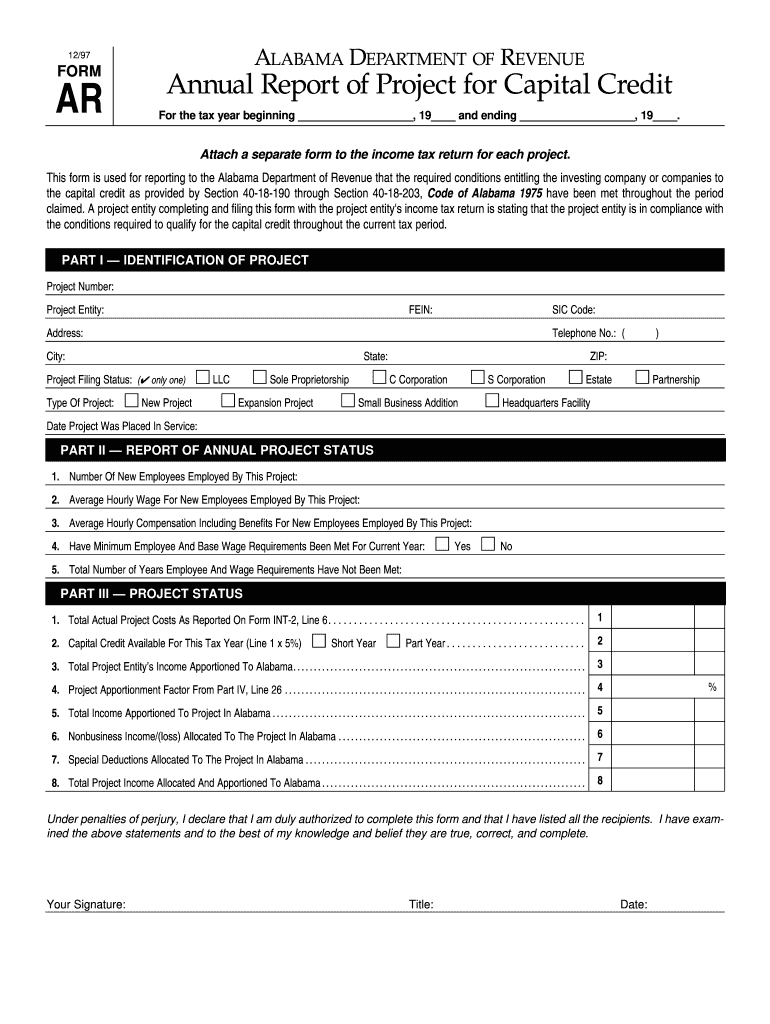

ALABAMA DEPARTMENT OF REVENUE 12/97 FORM Annual Report of Project for Capital Credit AR For the tax year beginning 19 and ending 19. 6. Nonbusiness Income/ loss Allocated To The Project In Alabama. 7. Special Deductions Allocated To The Project In Alabama. 2. Capital Credit Available For This Tax Year Line 1 x 5 Short Year Under penalties of perjury I declare that I am duly authorized to complete this form and that I have listed all the recipients. If the number is greater than three 3 the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your alabama capital form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama capital form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alabama capital online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit alabama tax form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out alabama capital form

How to fill out Alabama Department capital:

01

Visit the official website of the Alabama Department of Capital.

02

Locate the forms section on the website.

03

Download and print the Alabama Department capital form.

04

Carefully read the instructions on the form.

05

Gather all the required information and documents needed to complete the form, such as identification, financial statements, and any supporting documentation specific to your capital request.

06

Fill out the form accurately and legibly, ensuring that all the required fields are completed.

07

Double-check the form for any errors or missing information.

08

Attach any necessary documentation or supporting evidence to the completed form.

09

Submit the completed form and supporting documents to the designated address or office mentioned in the instructions.

Who needs Alabama Department capital:

01

Individuals or businesses located in Alabama in need of financial capital for a specific project or initiative.

02

Startups or entrepreneurs seeking funding to establish or expand their business in Alabama.

03

Non-profit organizations or community groups looking for financial assistance to support their programs or initiatives in Alabama.

Fill project alabama : Try Risk Free

People Also Ask about alabama capital

Does a personal representative have to file form 1310?

What is a 1310 form in Alabama?

What is an Alabama form 40?

How do I make a payment to the Alabama Department of Revenue?

Who needs to file form 1310?

What is Alabama income tax capital credit?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is alabama department capital?

The capital of Alabama is Montgomery.

Who is required to file alabama department capital?

There is no specific Alabama Department of Capital that individuals or entities are required to file with. However, businesses and individuals may be required to file various taxes and financial reports with the Alabama Department of Revenue based on their activities in the state. Entities such as corporations or partnerships may also be required to file with the Alabama Secretary of State.

How to fill out alabama department capital?

To fill out the Alabama Department Capital, follow these steps:

1. Visit the official website of the Alabama Department of Capital (if available) or obtain a physical copy of the form from their office.

2. Review the form instructions and make sure you understand what information is required.

3. Gather all relevant information and documents needed to complete the form. This may include financial records, asset information, and any other relevant documentation.

4. Begin filling out the form by entering your personal or business information as requested. This typically includes name, address, contact information, and identification numbers.

5. Provide detailed information about your capital assets. This may include a description of the asset, the date of acquisition, original cost, current value, and any depreciation or adjustments.

6. Attach any supporting documentation or schedules as requested by the form. This may include appraisal reports, receipts, or other documentation related to your capital assets.

7. Double-check all the information you have entered to ensure accuracy and completeness.

8. Sign and date the form where required.

9. Make a copy of the completed form and all supporting documentation for your records.

10. Submit the form to the Alabama Department of Capital as directed. This may involve mailing the form or submitting it electronically through their online portal.

It's important to note that the process may vary depending on the specific form you are filling out and the requirements of the Alabama Department of Capital.

What is the purpose of alabama department capital?

The Alabama Department of Capital is not a recognized government department or entity. It is possible that you may be referring to the Alabama Department of Finance, which plays a crucial role in managing the state's financial resources and ensuring fiscal integrity. The department is responsible for budgeting, accounting, cash management, procurement, and investment activities for the state government. Its purpose is to effectively and efficiently manage financial resources to support various programs and services provided by the state to its citizens.

What is the penalty for the late filing of alabama department capital?

The penalty for the late filing of Alabama Department capital depends on the specific circumstances and regulations. It is advised to check with the Alabama Department of Revenue or consult a tax professional for the most accurate and up-to-date information on penalties.

How can I send alabama capital to be eSigned by others?

alabama tax form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my alabama form 1310a in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form alabama and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the form 40 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign form alabama tax on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your alabama capital form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alabama Form 1310a is not the form you're looking for?Search for another form here.

Keywords relevant to alabama 40 form

Related to alabama department capital

If you believe that this page should be taken down, please follow our DMCA take down process

here

.